Analyzing monthly costs is essential before real estate investments or rental decisions. This includes rent/mortgage, taxes, insurance, utilities, and maintenance to make informed choices based on budget and requirements, especially in competitive markets. Historical data analysis reveals cost trends, aiding in budgeting for variations. Understanding fixed and variable expenses provides clear financial insights, aligning payments with income and goals, and identifying savings opportunities for strategic purchases.

Before diving into the real estate market, a thorough analysis of monthly costs is crucial. This guide breaks down essential components of real estate expenses, helping you navigate the financial landscape. Start by understanding the various cost factors—from mortgage payments and property taxes to insurance and maintenance. Then, gather historical data to predict future trends. Armed with this knowledge, make informed decisions based on meticulous cost analysis, ensuring a sound investment strategy in the competitive real estate market.

Understand Monthly Cost Components in Real Estate

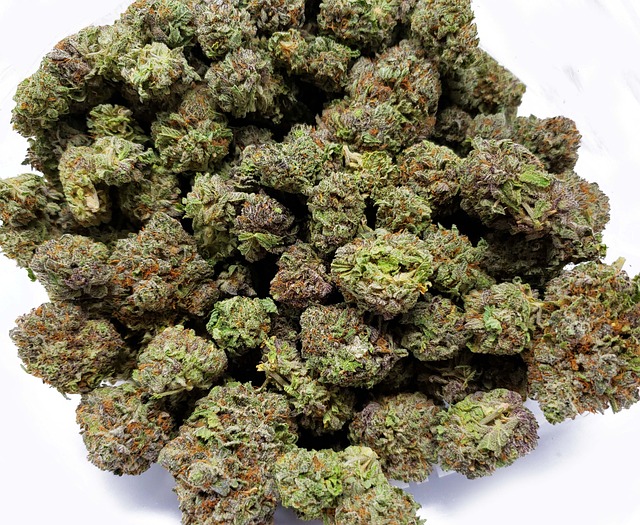

Understanding the various components that make up monthly costs is a crucial step before deciding on any real estate investment. In the realm of real estate, several factors contribute to your overall spending, including rent or mortgage payments, property taxes, insurance, utilities, and maintenance expenses. Each of these elements plays a significant role in your financial commitment. For instance, rent or mortgage interest is often the largest expense, while other costs can fluctuate depending on seasonal changes or the age of the property.

By breaking down these monthly cost components, potential buyers or renters can make more informed decisions. It allows them to compare different properties and locations, ensuring they find a place that aligns with their budget and needs. This process is especially important in today’s competitive real estate market where every dollar counts.

Gather And Analyze Historical Data

Before deciding on a new home or making significant changes to your current property, gathering and analyzing historical data is a crucial step in understanding your potential financial obligations. In the realm of real estate, past performance can paint a vivid picture of future expenses. Start by collecting data on previous months’ costs for similar properties in your desired location. This includes utility bills, property taxes, insurance premiums, maintenance fees, and any other regular expenses associated with ownership.

Historical analysis allows you to identify patterns and trends that might not be immediately apparent. By studying these records, you can anticipate potential cost fluctuations and make informed decisions. For instance, certain seasons may bring higher energy consumption and corresponding bills. Understanding these seasonal variations enables you to budget more effectively and avoid unexpected financial surprises.

Make Informed Decisions Based on Cost Analysis

Before taking the leap into any significant financial commitment, especially in the realm of real estate, understanding and analyzing your monthly costs is paramount. This process allows you to make informed decisions based on hard data rather than intuition or emotional biases. By delving into your budget and identifying fixed and variable expenses, you gain a clearer picture of your financial health.

In the world of real estate, this knowledge becomes your compass. It enables you to determine whether the monthly payments align with your income and overall financial goals. A thorough cost analysis can even help uncover hidden opportunities for savings or adjustments that might make a property more affordable without compromising quality. Ultimately, it’s about ensuring that your decision is not just an emotional purchase but a strategic move that respects your financial limits and possibilities.