Assessing responsibilities is crucial in real estate investments, as it reveals financial commitments and savings potential. Property management varies by type and market, with tasks ranging from tenant relations to financial analysis. Efficient management through digital tools saves costs, while hiring a property manager offers time-saving benefits but incurs additional expenses. Effective communication ensures positive outcomes for investors and managers alike.

In the dynamic realm of real estate, balancing responsibilities with overall savings is a delicate dance. This article navigates the intricate tapestry of investment decisions, exploring how aspiring landlords can optimize their time and finances. We dissect the breakdown of management tasks, delve into the pros and cons of hiring property managers, and calculate potential long-term savings compared to traditional ownership. Through case studies and strategic insights, we guide readers in striking a harmonious balance between active involvement and passive income.

Assessing Responsibilities in Real Estate Investments

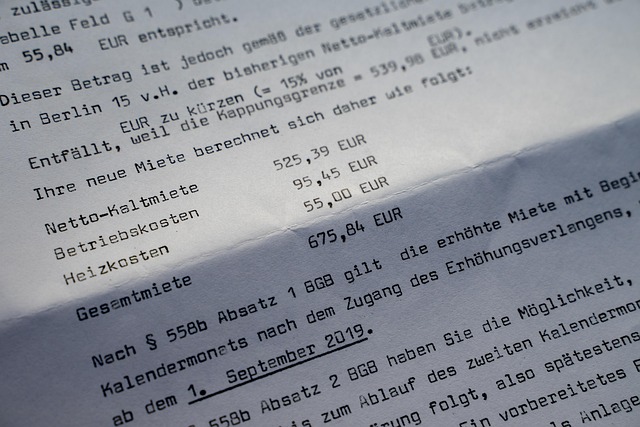

When considering real estate investments, assessing responsibilities is a crucial step in weighing overall savings. Property ownership comes with a range of obligations that extend beyond simply securing a loan and purchasing a home. From routine maintenance and repairs to ensuring compliance with local regulations, these duties can vary widely depending on the type of property and market conditions. It’s essential for investors to factor in these ongoing costs and manage them effectively to maximize savings over time.

Delving into specific responsibilities, such as property management, tax payments, insurance, and potential association fees, provides a clear picture of the financial commitment required. Moreover, understanding local market dynamics, including vacancy rates, property value fluctuations, and rental income potential, allows investors to anticipate both immediate and long-term savings. By meticulously evaluating these aspects, real estate investors can make informed decisions that balance responsibilities with overall financial health.

– Breakdown of management tasks and their impact on time commitment

In the realm of real estate, effective management requires a delicate balance between numerous tasks and the allocation of valuable time. The breakdown of these responsibilities can vary significantly from property to property, depending on size, location, and investment goals. For instance, a landlord managing a single apartment may spend most of their time on tenant relations and maintenance, while a commercial real estate investor overseeing multiple office buildings would focus more on financial analysis and leasing strategies. Each task demands dedication; from responding to tenant inquiries to negotiating lease terms or scheduling repairs. Understanding the time commitment required for each duty is crucial when assessing overall savings and efficiency.

In the dynamic world of real estate, optimizing these management tasks can lead to substantial cost savings. For example, implementing digital tools for rent collection and property maintenance requests streamlines processes, reducing manual labor costs. Additionally, efficient tenant screening methods minimize vacancies and legal disputes, saving time and money in the long run. As such, a thorough understanding of one’s management responsibilities is essential, as it directly influences the potential for maximizing savings and ensuring a profitable real estate investment.

– Hiring a property manager: Pros and cons

Hiring a property manager can be a weighty decision, especially for real estate investors aiming to maximize savings while managing their assets effectively. On the pros side, delegating property management tasks to professionals can save significant time and effort. They handle tenant screening, lease agreements, maintenance requests, and bill payments, allowing investors to focus on core aspects of their business or personal life. This is particularly beneficial for out-of-town landlords who cannot actively manage their properties.

However, there are cons to consider. Hiring a property manager incurs additional costs, which can eat into overall savings. Fees vary widely based on location and services offered, so investors must weigh these expenses against the benefits. Moreover, relying on outsiders to manage properties might reduce control over day-to-day operations and tenant interactions. Ensuring excellent communication and choosing a reputable manager is crucial to mitigate potential issues.