Real estate's dynamic nature emphasizes flexibility—adapting properties to diverse needs like open floor plans and eco-features. This benefits investors and residents alike, with desirable locations enhancing allure. Beyond financial investment, ownership offers security, stability, and control, fostering long-term wealth through equity building and property appreciation. Renting vs. owning presents a trade-off: agility vs. equity accumulation, stability vs. upfront investment, crucial for navigating real estate landscape and shaping lifestyle, financial health.

In the dynamic realm of real estate, understanding the balance between flexibility and ownership is key. This article delves into these dual benefits, offering a comprehensive comparison. We explore how flexibility empowers tenants with agility, while ownership provides stability and long-term advantages. By weighing the implications for both parties, we uncover insights that shed light on informed decision-making in the ever-evolving real estate landscape.

Understanding Flexibility in Real Estate

In the realm of real estate, flexibility refers to the ability to adapt and adjust properties to suit various needs and preferences. This could mean designing open floor plans for those seeking space and customization or incorporating eco-friendly features to appeal to environmentally conscious buyers. Flexibility in real estate goes beyond just design; it involves a range of benefits that cater to modern lifestyles. For instance, properties with adaptable spaces can easily transition from residential to commercial use, attracting a diverse set of potential tenants or owners.

Understanding flexibility in real estate is crucial for investors and residents alike. It empowers buyers to find spaces that align with their evolving requirements, whether it’s a growing family needing more room or a remote worker seeking a quiet retreat. Moreover, flexible properties often come with the advantage of being located in vibrant, bustling areas, offering easy access to amenities and community interactions. This dynamic nature makes such real estate assets highly desirable and potentially lucrative investments.

Unlocking Ownership Advantages

In the realm of real estate, unlocking ownership advantages can be a game-changer for many individuals and families. Owning property comes with a host of benefits that go beyond mere financial investment. One of the key advantages is the sense of security and stability it provides. With ownership, individuals have control over their living space, making modifications and personalizing it to suit their needs and tastes. This flexibility is particularly appealing in today’s fast-paced world where lifestyle changes can occur swiftly.

Furthermore, owning a property often translates to long-term financial benefits. While initial costs may be higher than renting, over time, homeowners can build equity through mortgage payments and property appreciation. This not only offers financial security but also serves as an investment for the future, especially when planning for retirement or intergenerational wealth transfer. Thus, embracing ownership in real estate can unlock a range of advantages that cater to both personal fulfillment and financial well-being.

Weighing Long-Term Implications

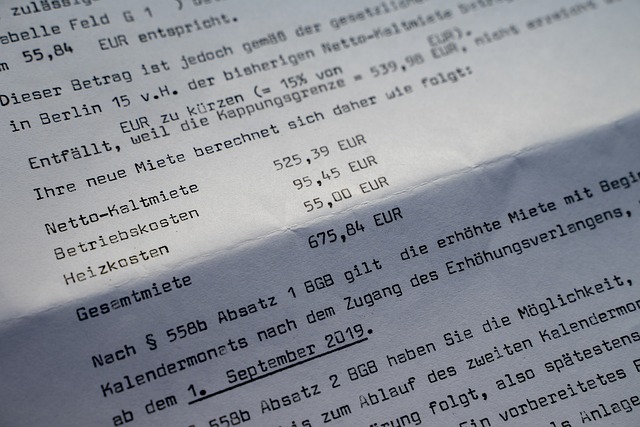

When considering flexibility versus ownership in real estate, evaluating long-term implications is crucial. Renting offers immediate agility, allowing tenants to move with ease and adapt to changing life circumstances. This freedom can be particularly appealing for younger generations or those with transient lifestyles. However, it comes at the cost of limited equity accumulation and potential instability over time.

In contrast, homeownership provides a sense of permanence and security. It fosters stability by building equity and offering protection against rising rental costs. Yet, it ties individuals to a specific location, reduces mobility, and demands significant financial commitment upfront. Weighing these factors is essential in navigating the real estate landscape, as they shape long-term financial health and lifestyle choices.