Real estate offers a spectrum of choices: traditional ownership or flexible leasing. Ownership provides stability, equity building, and customization freedom but incurs higher initial costs. Flexibility allows for shorter lease terms, exploration, and lower upfront expenses, ideal for mobile lifestyles. The best choice depends on individual preferences, financial goals, market conditions, and long-term plans, balancing the benefits of each to navigate the evolving real estate landscape.

In the dynamic realm of real estate, understanding the balance between flexibility and ownership is key to making informed decisions. This article navigates the intricate tapestry of these concepts, offering insights into their unique benefits. We explore how flexibility empowers tenants with adaptability, while ownership provides a solid foundation through equity building, stability, and long-term investment gains. By weighing the pros and cons, from initial costs to market fluctuations, readers can unlock the best path for their real estate journey.

Understanding Flexibility in Real Estate: This section will define flexibility in the context of real estate and outline its key advantages.

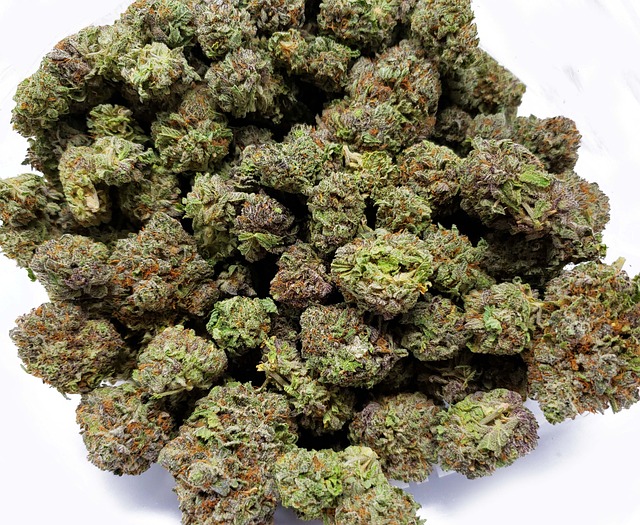

Flexibility in real estate refers to the ability to adapt and customize properties to meet changing needs and preferences. It involves various aspects, such as lease terms, space configurations, and property management practices, that collectively enable tenants and buyers to make the most of their living or working spaces. One of the key advantages of flexibility is its ability to foster a dynamic and responsive environment. Tenants can opt for shorter lease periods, allowing them to explore different locations without long-term commitments. This encourages experimentation and facilitates frequent changes, catering to those with transient lifestyles or evolving requirements.

Furthermore, flexible real estate practices offer cost savings and enhanced comfort. For instance, easily convertible spaces cater to diverse uses, whether it’s a home office, co-working space, or multi-purpose area. This adaptability can reduce the need for significant renovations or multiple moves, saving time and money. In today’s dynamic market, understanding and leveraging flexibility becomes crucial for both tenants and property owners alike, ensuring that real estate remains accessible, efficient, and aligned with modern lifestyles.

Unlocking Ownership Benefits: Here, we'll explore the traditional benefits of owning property, such as equity building, stability, and long-term investment gains.

Owning property comes with a host of advantages that extend far beyond just having a place to live. One of the most significant benefits is the potential for equity building. When you pay off your mortgage, the value of your real estate investment increases, providing you with a financial asset. This equity can serve as a safety net in retirement or be leveraged for other opportunities, such as investing in another property.

Moreover, owning a home offers stability and security. It provides a sense of permanence, knowing that you’re not at the mercy of rising rents or the possibility of your landlord selling the property. This long-term investment gains ground over time, especially in appreciating real estate markets, making ownership a solid financial strategy for many individuals.

Weighing the Pros and Cons: A comparative analysis of flexibility versus ownership, considering factors like initial costs, long-term goals, lifestyle preferences, and market fluctuations.

When weighing the pros and cons of flexibility versus ownership in real estate, several key factors come into play. Those considering their options often prioritize initial costs, which can be significantly lower for renting or flexible leasing arrangements compared to purchasing a property outright. This accessibility allows individuals and families to explore different neighborhoods and lifestyles without the long-term commitment and financial burden of homeownership. However, ownership comes with its own set of advantages, such as building equity through mortgage payments, potential appreciation in property value over time, and the freedom to customize and renovate according to personal preferences.

Long-term goals also influence this decision. Ownership can align better with aspirations for stability and wealth accumulation over decades, whereas flexibility is more suitable for those with mobile lifestyles or uncertain future plans. Lifestyle preferences play a role too; some people thrive in the constant change and variety that renting offers, while others prefer the security and permanence of owning their own space. Additionally, market fluctuations can impact both scenarios; ownership can be affected by interest rates and property values, whereas flexible arrangements may be more resilient to economic shifts, as tenants are not tied to specific mortgage terms or market highs and lows.