Before committing to a new home, assess your basic monthly outlays including rent/mortgage, utilities, internet, and transportation. Compare real estate options by evaluating utilities, property taxes, and maintenance fees for a comprehensive financial picture. Allocate a budget buffer for variable and unpredictable costs like maintenance and unexpected repairs to avoid future financial strain in today's competitive real estate market.

Before making a real estate decision, a thorough analysis of your monthly costs is essential. This guide breaks down the steps to ensure you’re prepared financially. Start by assessing your basic monthly expenses and comparing them across different properties. Don’t overlook variable costs and unexpected expenses; these can significantly impact your budget. By factoring in every cost, from utilities to potential repairs, you’ll gain a clear understanding of what’s affordable and what’s not in the competitive world of real estate.

Assess Basic Monthly Expenses

Before deciding on a new place to call home, take time to assess your basic monthly expenses. This includes rent or mortgage payments, utilities like electricity and water, internet access, and transportation costs. Understanding these core expenditures is crucial for making an informed decision about your budget and lifestyle.

When evaluating real estate options, consider not just the cost of the property but also how it aligns with your overall financial picture. By gauging your basic monthly expenses, you can better determine if a new location is feasible and aligns with your financial goals, ensuring a smoother transition without unexpected financial strain.

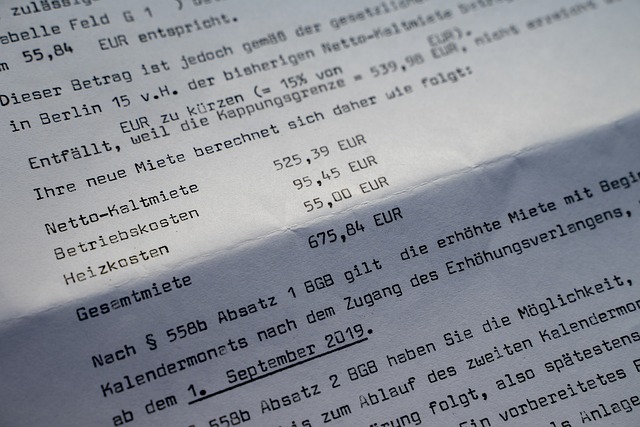

Compare Across Properties

When analyzing monthly costs before deciding on a property, it’s crucial to compare across different real estate options. This involves scrutinizing not just the base rent or mortgage payment but also evaluating additional expenses such as utilities, property taxes, and maintenance fees. By comparing these factors across various properties, you gain a clearer picture of your financial commitment and can make more informed decisions.

Real estate websites and local market reports offer valuable insights into typical monthly costs associated with different types of dwellings. This comparative analysis enables you to identify not just the most affordable option but also the one that best aligns with your budget and lifestyle preferences. Remember, understanding these varying costs upfront can save you from unexpected financial surprises down the line.

Factor In Variable Costs & Unexpected Expenses

Before making a decision on a new property, especially in the competitive real estate market, it’s crucial to have a comprehensive understanding of your potential monthly costs. One often overlooked aspect is the inclusion of variable costs and unexpected expenses. These can significantly impact your financial stability and overall budget.

Variable costs, such as maintenance fees, utilities, and home insurance, can vary depending on factors like the location, size, and age of the property. Unexpected expenses, like emergency repairs or medical bills, are inevitable over time. It’s essential to create a buffer in your budget to accommodate these variable and unpredictable costs to avoid financial strain later. By considering these elements, you’ll be better prepared to navigate the real estate landscape with confidence and make informed decisions about your future home.