Researching local real estate market data through government and industry websites provides comprehensive insights into property sales, listings, and values. Analyzing historical price trends helps identify patterns and economic factors influencing property values. Comparing similar properties within the region enables informed decisions about market growth, promising areas, and realistic expectations of property values.

Evaluating local market price trends is crucial for both real estate investors and sellers. To stay ahead of the curve, research local real estate market data thoroughly. Dive into historical price trends to identify patterns and fluctuations. Compare properties within the region to gauge current market values accurately. By analyzing these key aspects, you’ll gain valuable insights into the local real estate landscape, enabling informed decision-making.

Research Local Real Estate Market Data

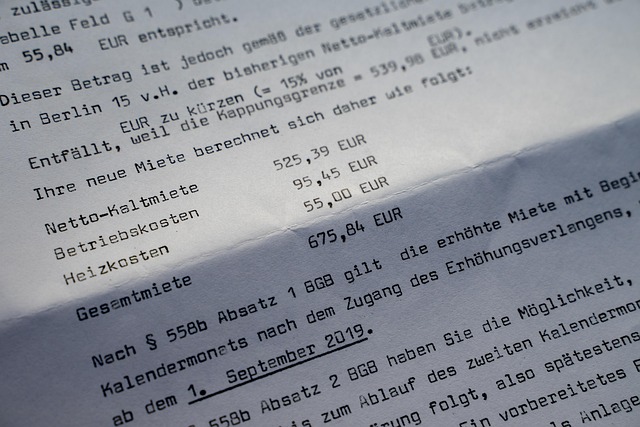

Researching local real estate market data is a crucial step in evaluating price trends. Start by exploring government and industry-specific websites that offer comprehensive insights into property sales, listings, and market values. These sources often provide up-to-date information on median home prices, sale rates, and neighborhood trends, giving you a clear picture of the local real estate landscape.

Delve into historical data to identify patterns and fluctuations in property values over time. Analyze recent sales transactions to understand current market dynamics, including any shifts in price points due to seasonal changes or economic factors. By combining these data points, you’ll gain valuable knowledge about the real estate market’s ebb and flow, enabling more informed decisions when assessing local price trends.

Analyze Historical Price Trends

When evaluating local market price trends in real estate, analyzing historical price data is a crucial step. By studying past sales records and listing prices over an extended period, investors and buyers can identify consistent patterns or sudden shifts that may indicate a favorable or challenging market. This involves comparing year-over-year changes, tracking peak seasons, and identifying any outliers that could skew the average.

Historical trend analysis also helps in understanding the broader economic factors influencing property values. For instance, trends in local employment rates, population growth, and interest rates often have a significant impact on real estate prices. By correlating these data points, individuals can make more informed decisions regarding investments, purchases, or sales, ensuring they stay ahead of the curve in an ever-changing market.

Compare Properties Within the Region

When evaluating local market price trends in real estate, it’s crucial to compare properties within the region. This involves examining homes or investments that are similar in terms of size, age, location, and amenities. By doing so, you gain a clearer picture of the average property values and pricing dynamics specific to your area. For instance, if new constructions are driving up prices, comparing older, established properties can help benchmark current market rates.

This comparative analysis allows investors and buyers to make informed decisions. It enables them to understand whether the local real estate market is experiencing growth or decline, and identify areas where investments may offer better returns. Additionally, understanding regional price trends helps in setting realistic expectations about property values, ensuring that transactions are fair and aligned with market conditions.