Aligning investment strategy with risk tolerance and time horizon is key for long-term financial goals. Real estate, suitable for moderate risk tolerances and long horizons, offers growth potential and stability but is subject to market volatility. Traditional investments like stocks and bonds better suit higher risk aversion or shorter windows. Diversifying real estate portfolio across sectors and locations reduces risk and enhances potential for substantial long-term gains. A robust financial plan including real estate investments can provide capital growth, inflation hedge, and steady income stream in retirement, securing a financially stable future.

“Achieving long-term financial stability requires strategic planning, especially when considering retirement and wealth preservation. This article guides you through crucial steps to secure your future. First, evaluate your risk tolerance and time horizon—a critical factor in determining investment strategies. We then explore the benefits of real estate investments, a diverse asset class known for its potential long-term growth. Finally, learn how to develop an all-encompassing financial plan tailored for longevity, ensuring financial security for years to come, with a special focus on real estate as a key component.”

Evaluate Your Risk Tolerance and Time Horizon

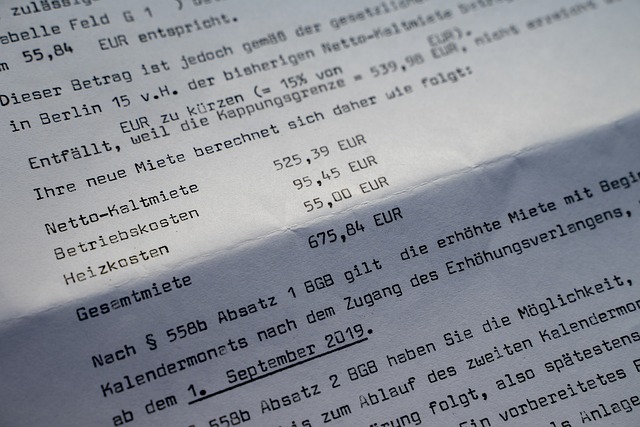

When setting long-term financial stability goals, understanding your risk tolerance and time horizon is paramount. Your risk tolerance refers to how much volatility and potential loss you’re comfortable with in your investment portfolio. If you’re nearing retirement, for instance, you might have a lower risk tolerance since you need the funds soon. On the other hand, if you’re saving for your child’s education in 15 years, you may be able to afford a higher level of risk as you have a longer time horizon to recover from market downturns.

Real estate can play a significant role here. It offers both potential for growth and stability, but it also comes with risks like market fluctuations and property values dropping. If your risk tolerance is moderate and your time horizon is substantial, investing in real estate could be strategic. Conversely, if you’re risk-averse or have a short time frame, traditional investments like stocks and bonds might be more suitable as they offer more liquidity and lower volatility.

Explore Real Estate Investment Strategies

Investing in real estate can be a powerful strategy for long-term financial stability and growth. With careful planning, it offers diverse options like buying residential properties to rent out, commercial spaces for business tenants, or even investing in mixed-use developments. These investments not only provide regular income streams but also appreciate over time, offering significant returns on investment.

Exploring different real estate sectors is key. From urban apartments to suburban homes and industrial warehouses, each has unique characteristics and potential. Understanding market trends, demographic shifts, and local economies helps in identifying lucrative opportunities. Diversifying your portfolio across various types of properties and locations can mitigate risks and maximize gains, contributing to a robust long-term financial strategy.

Develop a Comprehensive Financial Plan for Longevity

Creating a robust financial plan is paramount when considering long-term stability, especially as one ages. A comprehensive strategy should encompass various aspects, with a key element being real estate investments. This asset class offers not just potential capital growth but also serves as a hedge against inflation, providing a steady stream of income in retirement.

A well-rounded financial plan might include diversifying your real estate portfolio across different property types and locations to mitigate risks. It’s also beneficial to factor in future expenses, such as healthcare costs, which can significantly impact long-term financial stability. By thoughtfully incorporating real estate into your strategy, you can pave the way for a secure financial future.