Securing long-term financial stability through strategic goal setting emphasizes the significant role of real estate investment. Diversifying wealth by purchasing rental properties or commercial spaces offers tangible assets, passive income, and potential capital appreciation, historically proving reliable during economic downturns. Balancing budget constraints, market trends, personal circumstances, and ongoing costs is crucial for effective planning; rebalancing investments regularly helps navigate risks. While higher-risk ventures like flipping or land development yield greater returns, they necessitate careful consideration and expertise. Strategic real estate planning contributes to financial independence and a robust legacy.

In today’s fast-paced world, achieving long-term financial stability is a cornerstone of secure living. This article guides you through understanding and setting realistic financial goals that serve as your compass in navigating the financial landscape. We explore strategies where real estate plays a pivotal role in safeguarding your future. Furthermore, discover actionable steps to build and sustain a robust financial legacy that transcends time, ensuring peace of mind for years to come.

Understanding Long-Term Financial Stability: Setting Realistic Goals

Understanding long-term financial stability involves setting realistic goals that cater to your aspirations and current financial situation. One key area to consider is real estate, which can serve as a solid foundation for wealth accumulation over time. Investing in property, whether it’s purchasing a home or acquiring rental properties, offers several advantages. It not only provides a tangible asset but also has the potential for significant appreciation, generating passive income and building long-term equity.

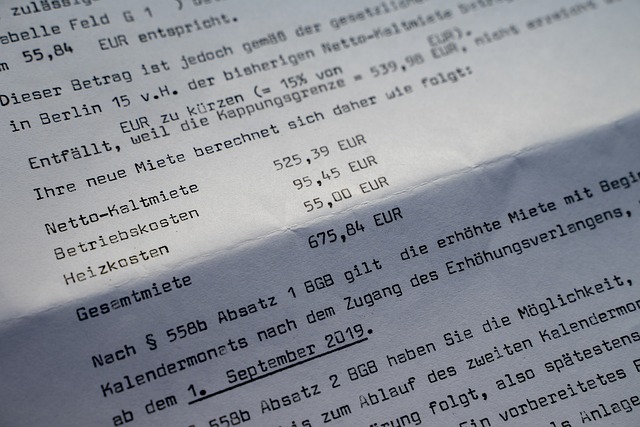

When setting goals related to real estate, it’s crucial to be realistic about your budget, market trends, and personal circumstances. This may involve determining a comfortable price range for a property purchase, exploring different investment strategies like buying multiple properties or focusing on high-return areas, and considering the ongoing costs associated with homeownership or renting out properties. By aligning your financial goals with practical considerations, you can ensure that your long-term stability plans remain achievable and adaptable to life’s changes.

The Role of Real Estate in Achieving Financial Security

Investing in real estate has long been recognized as a cornerstone for achieving long-term financial stability and security. It offers individuals and families a unique opportunity to build wealth over time, providing both income generation and potential capital appreciation. The power of real estate lies in its ability to offer diverse options—from purchasing residential properties that can be rented out, generating consistent cash flow, to investing in commercial spaces that cater to growing businesses.

This asset class provides stability during economic downturns as it has historically proven to be a reliable storehouse of value. Moreover, owning property allows individuals to benefit from equity growth over the years, providing financial security for retirement or future generations. With careful planning and strategic moves in the real estate market, one can secure a solid financial foundation, ensuring long-term prosperity.

Strategies for Building and Sustaining Your Financial Legacy

Building a financial legacy is a marathon, not a sprint. It requires strategic planning and consistent effort to achieve long-term stability. One powerful strategy involves real estate investment. Diversifying your portfolio with properties can offer stable income streams and potential appreciation over time. Consider purchasing rental units or investing in commercial spaces to generate passive income, a key component of financial independence.

Regularly reviewing and rebalancing your investments is crucial. Market fluctuations can impact the value of your assets, so staying agile allows you to capitalize on opportunities and mitigate risks. Additionally, exploring strategies like property flipping or developing land can offer substantial returns but come with higher stakes. With careful consideration and expertise, these approaches can contribute significantly to your financial legacy, ensuring a secure future.