Understanding local market dynamics is crucial for navigating or investing in real estate. Demographic shifts, economic health, infrastructure upgrades, and environmental concerns significantly impact property prices and neighborhood character. Real estate professionals leverage data-driven tools for advanced analysis, enabling informed decision-making and successful navigation of market trends. By interpreting historical data and patterns, investors can anticipate future price movements, capitalize on growth opportunities, or mitigate risks in a competitive real estate landscape.

Stay ahead of the curve in the ever-evolving real estate market by evaluating local price trends. This comprehensive guide walks you through understanding intricate local dynamics, from key factors influencing property values to data-driven analysis techniques. Armed with insights from both macro and micro perspectives, you’ll learn effective strategies for interpreting trends, enabling confident decision-making amidst market fluctuations.

Understanding Local Market Dynamics: Uncover Key Factors Influencing Real Estate Prices

Understanding local market dynamics is crucial for anyone looking to navigate or invest in real estate. A multitude of factors influence property prices, each contributing to the unique character and value of different neighborhoods. Demographic shifts, such as population growth or declining employment rates, can significantly impact demand and subsequently drive up or down property values. Local economic health, including industry changes and new business developments, also plays a pivotal role in shaping real estate markets.

Furthermore, infrastructure upgrades like road construction or public transportation expansion can enhance the desirability of certain areas, boosting property prices. Conversely, environmental factors such as natural disasters or pollution concerns might deter investment in specific locations. Keeping abreast of these dynamics allows buyers, sellers, and investors to make informed decisions, capitalize on emerging trends, and navigate local real estate markets with confidence.

Data-Driven Analysis: Tools and Techniques for Tracking Price Trends

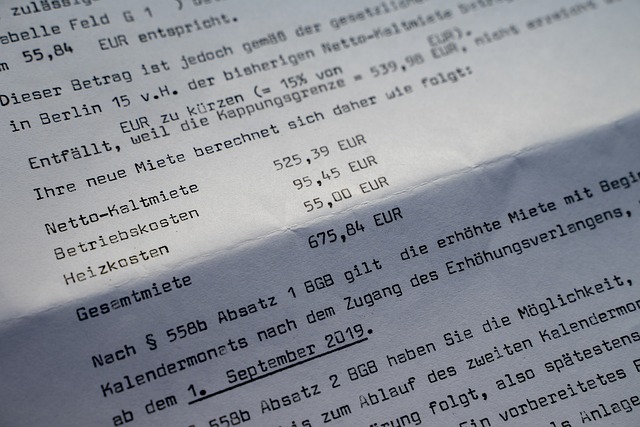

In today’s digital era, real estate professionals have access to a plethora of tools for data-driven analysis, which is crucial for evaluating local market price trends. These tools offer efficient and accurate methods to track historical prices, identify patterns, and make informed decisions. Advanced software platforms now allow agents and investors to monitor market fluctuations in real-time, providing valuable insights into supply and demand dynamics. By analyzing past sales data, current listings, and even future projections, these technologies enable users to stay ahead of the curve.

Among the techniques employed is the use of price indices and comparison tools that facilitate direct comparisons between various properties. This helps in understanding market values across different segments, be it residential, commercial, or industrial real estate. Additionally, predictive analytics models utilize historical data to forecast future price movements, assisting professionals in adapting their strategies accordingly. These data-driven approaches not only enhance decision-making processes but also ensure that every move in the competitive real estate landscape is well-informed and strategic.

Interpreting Trends: Strategies to Make Informed Decisions in a Fluctuating Market

Interpreting trends is a crucial strategy for making informed decisions in the fluctuating real estate market. By examining historical data, patterns emerge that can signal future price movements. Investors and agents who stay abreast of these trends can anticipate shifts, enabling them to make timely adjustments to their strategies. For instance, upward trends might indicate a growing economy or high demand, prompting investors to consider expanding their portfolios. Conversely, downward trends could signal market saturation or economic downturns, encouraging sellers to renegotiate prices or buyers to be more discerning.

To effectively interpret these trends, it’s essential to analyze various factors such as demographic changes, interest rates, and local infrastructure developments. Additionally, keeping an eye on comparable sales—properties similar in size, location, and features—provides valuable insights into the market’s overall health. Incorporating these strategies allows participants in the real estate market to navigate fluctuations with confidence, ensuring they capitalize on opportunities or mitigate risks accordingly.