When evaluating real estate investments, understanding fixed expenses—like mortgage payments, property taxes, insurance, and maintenance fees—is key. These costs remain consistent over time. Distinguish between negotiable (e.g., insurance, lease terms) and non-negotiable (e.g., rent, taxes) expenses to build a robust financial plan. Analyzing potential monthly costs, including property taxes, insurance, and mortgage payments, is essential for informed real estate decisions that align with your budget and financial goals.

Before diving into the vibrant world of real estate, it’s crucial to analyze your monthly costs. Navigating the financial landscape of a new home involves understanding both fixed and variable expenses. Assess fixed costs like property taxes and insurance, and variable costs such as utilities and maintenance fees. By prioritizing discretionary spending, you can ensure your budget aligns with your needs and wants. This comprehensive guide will equip folks with the knowledge to make informed decisions in the real estate realm.

Assess Fixed Expenses in Real Estate

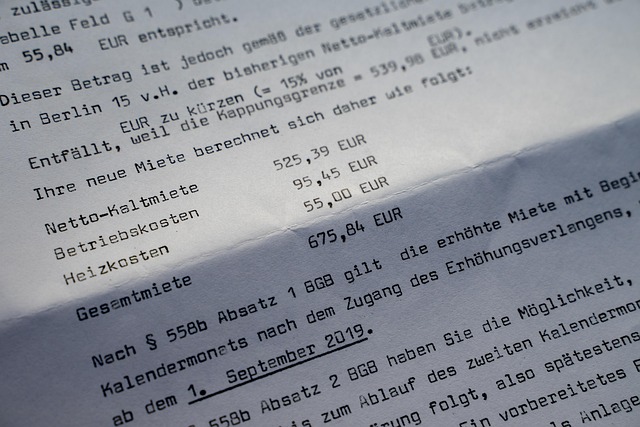

When analyzing monthly costs before deciding on a real estate investment, it’s crucial to assess fixed expenses. These are predictable and consistent costs associated with owning property, such as mortgage payments, property taxes, insurance, and maintenance fees. Understanding these fixed costs is essential for budgeting and planning. For instance, your mortgage payment remains relatively stable over time, providing a reliable expense to factor into your financial plans.

In the world of real estate, other fixed expenses may include association fees, which cover the upkeep of common areas or pool maintenance, and property taxes that are levied by local governments. These costs can vary based on location and the specific property, so it’s important to research and budget accordingly. Delve into these details to avoid financial surprises and ensure a solid foundation for your investment decisions.

– Identifying non-negotiable costs

When analyzing monthly costs before making a decision, it’s crucial to differentiate between negotiable and non-negotiable expenses. Non-negotiable costs are those that remain constant regardless of your financial strategies or bargaining skills. Real Estate, for instance, is often a significant portion of most people’s budgets, encompassing rent or mortgage payments, property taxes, and homeowners’ or renters’ insurance. These costs are typically set by market rates and legal agreements, making them less flexible in the short term.

Identifying non-negotiables early on allows you to establish a solid financial foundation. Understanding these fixed expenses helps in creating a realistic budget and avoiding surprises later. It’s also essential to recognize that while some costs are non-negotiable, there might be opportunities for optimization within those categories. For example, shopping around for better insurance rates or negotiating lease terms can slightly reduce Real Estate costs without fundamentally altering your housing arrangement.

– Examples: property taxes, insurance, mortgage payments (if applicable)

Before diving into any real estate decision, it’s crucial to analyze your potential monthly costs. Consider property taxes, which can vary significantly depending on location and the value of your property. Insurance is another essential expense, whether it’s homeowners or rental insurance, covering unforeseen events that could impact your investment. For those with mortgages, monthly payments are a significant part of their budget, and understanding these obligations is vital for financial planning.

These costs form the backbone of your real estate expenses and should be given careful consideration alongside any potential income generated from renting or selling properties. By assessing these variables, you can make more informed decisions about your real estate ventures, ensuring they align with your financial goals and overall budget.