Assessing fixed costs like mortgage payments, property taxes, insurance, and maintenance fees is crucial for real estate investors before committing. These expenses remain consistent regardless of occupancy and can vary based on location, property type, and age. Thorough research and expert consultation help anticipate these costs accurately, enabling informed investment decisions and ensuring financial alignment with one's goals and lifestyle preferences.

Before diving into the vibrant real estate market, a crucial step in your journey is analyzing monthly costs. Understanding your financial obligations beyond the initial purchase price is essential for long-term financial health. This article guides you through the process, focusing on fixed costs like mortgages and property taxes, variable expenses such as utilities and maintenance, and lesser-considered commitments like homeowners association fees. By breaking down these aspects, you’ll be equipped to make informed decisions in the real estate realm.

Assess Fixed Costs in Real Estate

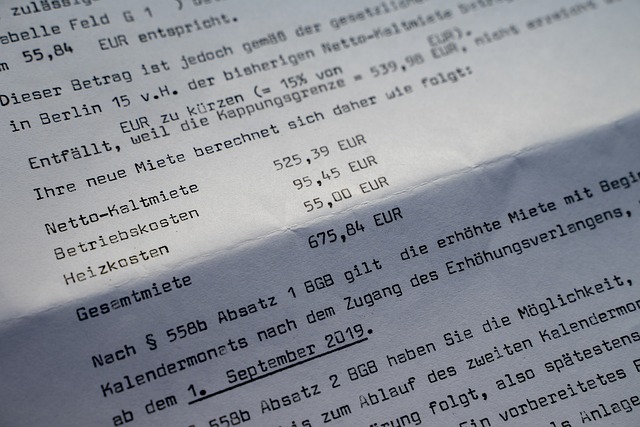

When considering a real estate investment, assessing fixed costs is a crucial step before deciding. Fixed costs in real estate refer to expenses that remain relatively consistent over time and are independent of the property’s occupancy or revenue. These include mortgage payments, property taxes, insurance premiums, and maintenance fees. Understanding these costs is essential as they constitute a significant portion of your overall expenditure. By evaluating fixed costs, investors can gain a clearer picture of the financial commitment required to maintain and operate the property.

In the world of real estate, it’s important to note that fixed costs can vary widely depending on the location, type, and age of the property. For instance, properties in urban areas might have higher property taxes and insurance rates due to increased risk factors. Conversely, older buildings may require more frequent maintenance, thereby inflating fixed expenses. Investors should conduct thorough research and consult with financial experts to accurately anticipate these costs and make informed decisions that align with their investment goals.

– Break down monthly expenses like mortgage payments, property taxes, and insurance.

Before deciding on a real estate purchase, it’s crucial to analyze your monthly costs. Break down your expenses into key components like mortgage payments, property taxes, and insurance. These are significant financial obligations that can significantly impact your overall budget. Mortgage payments, in particular, vary based on factors such as the loan amount, interest rates, and repayment terms. Understanding these variables is essential for determining how much you can afford without compromising other necessary expenditures.

Property taxes, another substantial cost, are typically based on the assessed value of the property. These taxes contribute to local services and infrastructure, but they can vary widely between locations. Insurance, whether it’s homeowners or title insurance, protects your investment but comes at a cost. By meticulously evaluating these monthly expenses, you gain a clear picture of what financial commitments lie ahead, enabling more informed real estate decisions.

– Discuss the importance of understanding long-term financial obligations.

Before deciding on a new home or investing in real estate, understanding your long-term financial obligations is crucial. It’s easy to get caught up in the excitement of a potential new residence and overlook the recurring costs associated with ownership. Monthly expenses such as mortgage payments, property taxes, insurance, utilities, and maintenance can significantly impact your budget over time. By analyzing these costs beforehand, you gain valuable insights into your financial future and make informed decisions about your affordability and long-term sustainability.

This proactive approach allows you to set realistic expectations and avoid financial surprises. It’s not just about the initial purchase price of a property; it’s about embracing the responsibility of being a homeowner or investor. By considering these ongoing expenses, you can ensure that your choice aligns with your financial goals and lifestyle preferences, leading to greater satisfaction and security in the long run.